What Is Medicare? Medicare is a government run program that helps people 65 and older pay for their health care. Some younger folks with certain health conditions may also participate. Basic Medicare from the government has 2 parts: Medicare Part A and Medicare Part B.

Basic Medicare: Part A and B

- Medicare Part A: Helps pay part of hospital stays.

- Medicare Part B: Helps pay part of doctor visits and other outpatient services.

The vast majority of people who are on Medicare have additional coverage to reduce their out-of-pocket costs for outpatient drugs and medical care. Additional Medicare plans (Medicare Advantage, Part D Drug plans and Supplement plans) are available through private insurance companies but are governed by the Center of Medicare and MediCAID services (a government entity).

For more details, you can visit the official Medicare website.

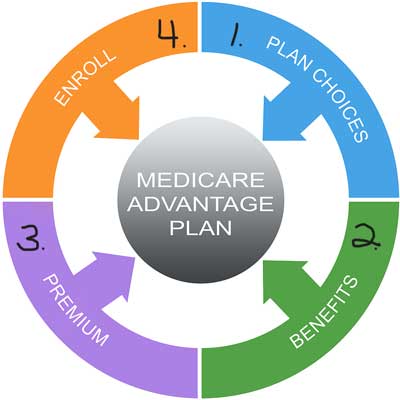

Medicare Advantage Plans

Advantage plans (Part C of Medicare) are a one-stop-shop for health care. Offered by private insurance companies contracted with Medicare (you always pay your monthly Part B premium to the government). Most Advantage plans have co-pays, a Primary Care Provider (PCP), include prescription drug coverage (Part D) and additional benefits like vision, hearing, and dental.

Under an HMO Advantage plan, you get care through a network of doctors and hospitals.

Under a PPO Advantage plan, you get out of network coverage but usually at a higher charge than if you stayed in network.

Curious about your options? We are here to help! Let’s team up.

Part D-Drug Plan

Medicare Part D-Drug Plans help with outpatient drug costs. Most companies have 3 drug plan choices. Lower priced plans are characterized by having fewer drugs, an annual deductible, and usually restricted to a certain pharmacy group to get the best price.

What happens if you don’t join a Part D-Drug plan (or a plan that includes Part D)? (Go to Frequent Questions, click on Medicare Lifetime Penalties)

How do you pick a drug plan? Click on the “get a quote” button, input your zip code, drugs, dosages, frequency, and pharmacy. It shows your monthly premium and the out-of-pocket drug cost under multiple plans.

We’re here to help you find the right drug plan for you’re needs.

Medicare Supplement (Medi-Gap)

Original Medicare (Part A & B) only pays about 80% of costs, (not including deductibles), so most people select added coverage. One group of options is a Supplement plan (Medigap). From private insurance companies, these plans help cover some of the out-of-pocket costs above what Medicare pays for a covered bill.

Supplement monthly cost increases for two reasons: your new attained age and “Medical Inflation”.

With a Supplement, you can ask any doctor in America: “Are you accepting a new Medicare patient?” If they say yes, you can go there. If no, call a different doctor.

Part D-Drug plan coverage for outpatient drugs is not included in your Supplement. If you delay signing up for a plan when first eligible you may start growing a lifetime penalty. (Go to Frequent Questions, click on Medicare Lifetime Penalties)

Let’s talk about your choices and get you the protection you deserve.